Building a Stripe App for Sales Tax Registrations and Reporting Automation

95%

Reduction in Manual Processes3x

Improvement in Operational Efficiency80%

Faster Sales Tax RegistrationsCustomer Overview

Our client, a sales tax expert, serves businesses that use Stripe (a payment aggregator connecting digital portals and marketplaces) to process payments and collect sales tax from their customers. They help these businesses register with the appropriate state tax portals across the U.S. and manage the entire process, from collecting sales data to calculating tax obligations and remitting payments to the respective state authorities on their behalf.

Project Overview

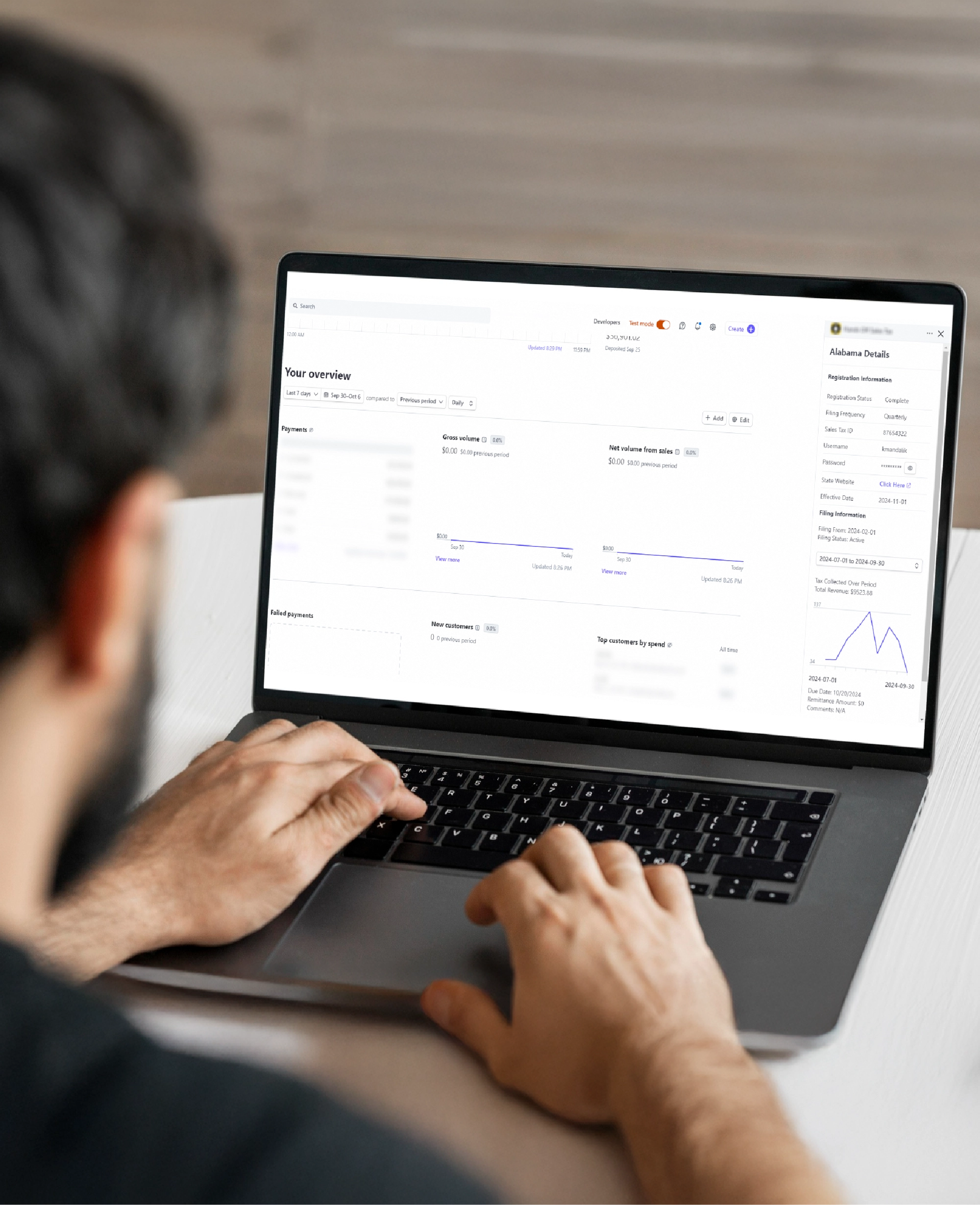

Our client aimed to streamline and digitize their sales tax processing services while providing a seamless experience to their customers. They wanted to eliminate the need for collecting sales data from customers and offer complete visibility into tax processing status, along with access to real-time and historical tax reports. To achieve this, they partnered with TenUp Software Services to build a Stripe app, designed to be listed on the Stripe App Marketplace and accessible directly from the Stripe Dashboard to Stripe-registered businesses. This sales tax automation software must facilitate sales tax processing by generating filing-ready data for our client and providing filing status updates and reports to their customers.

Challenges

Building a Stripe app for sales tax automation that balances strict platform limitations with complex client needs, while handling unsupported use cases and addressing diverse state filing requirements.

- We must design a Stripe app that accommodates our client’s all requirements as relevant features while working within the strict guidelines and UI restrictions of the Stripe Marketplace.

- The app must collect sales data directly from Stripe for all customers registered on the app for sales tax processing. It should calculate tax obligations and provide them in a filing-ready format to our client, even if the Stripe platform does not natively support this use case.

- The app must feed sales data and tax obligations into our client’s Salesforce CRM in line with their existing processes, and fetch filing-related data from Salesforce for customer reporting.

- As sales tax authorities in different U.S. states have varied requirements for filing registration, we must handle the complexity to support compliance.

Solution

We built and deployed a Stripe Marketplace app that automates U.S. sales tax registration, integrates with Salesforce for seamless data exchange, and provides users with accurate tax status and reports.

- Developed a web application as a U.S. sales tax automation software and hosted it on the Stripe marketplace.

- Using Figma design, ReactJS and Stripe UI components, engineered its frontend. Build a lightweight backend utilizing Cloudflare Workers, Wrangler, NodeJS and a serverless architecture.

- Navigated UI challenges to develop flexible, compliant features to support varied tax registration needs of all U.S. states. Customized a functionality for file upload, unsupported by Stripe, to allow users to submit documents for registration.

- Developed a utility to fetch large volumes of sales data (in terabytes) from Stripe and store it in a PostgreSQL database hosted on Microsoft Azure Cloud. This utility calculates tax obligations and automatically inputs them into our client’s Salesforce in a filing-ready format.

- Built data pipelines to send and retrieve data from Salesforce. The Stripe app pulls real-time and historical tax filing data from Salesforce and uses Stripe’s reporting APIs to visualize filing data through graphs and reports.

- Integrated the Stripe payment gateway to allow app users to pay the fees for sales tax registrations and filing services.

Benefits

The Stripe app for sales tax registrations and reporting automation provided the following benefits to users and our client:

- Real-time visibility into tax filing status and history for app users with automated dashboards and reports.

- 95% reduction in manual data entry through automated sales data extraction from Stripe and seamless input into Salesforce.

- 3x improvement in operational efficiency for the client’s team through process automation and Salesforce integration.

- 80% faster onboarding for new businesses across all 50 U.S. states with state-specific features and document upload support.

Technology

- ReactJS

- NodeJS

- Wrangler

- Cloudflare Workers

- Stripe UI Components

- Stripe Reporting APIs

- Stripe Payment Gateway

- PostgreSQL

- Microsoft Azure

Industry

- Sales Tax Consultancy / Accounting

Conclusion

Our custom-built Stripe Marketplace app automated sales tax processing and delivered a seamless and transparent experience for users, complete with accurate, real-time reporting. By integrating with Salesforce, the solution reduced manual effort for our client’s team and accelerated tax registrations, effectively streamlining their operations.

Frequently asked questions

Can I use the official Stripe JavaScript SDK directly in Workers?

Yes, Cloudflare Workers now support the Stripe JS SDK natively. You can call functions like stripe.customers.create() without REST rewrites or extra configuration.

What are the limitations of using PostgreSQL with Cloudflare Workers?

Cloudflare Workers don’t support native TCP, so PostgreSQL access requires HTTP proxies or edge-compatible drivers. This adds latency, limits real-time performance, and requires stateless, async design patterns. Local storage isn't available, and vertical scaling in PostgreSQL can become a bottleneck for high-throughput apps.

How do you manage large data volumes (e.g., terabytes of Stripe data)?

Fetch incrementally via paginated Stripe API calls in Workers, stream results into Azure-hosted PostgreSQL, and compute tax obligations using Node.js in micro-batches to avoid timeouts.

How do you handle multi-state tax workflows in the UI within Stripe Dashboard constraints?

Use Stripe UI components with React and Figma-based designs to build dynamic, state-specific tax workflows—like conditional document uploads—while complying with strict Stripe Marketplace UI and UX guidelines to ensure functionality across all 50 states.

How do Cloudflare Workers compare against Workers Functions or Pages?

Cloudflare Workers offer full-edge runtime access for custom APIs and logic, with support for KV, Durable Objects, and global low-latency execution. Pages and Functions are streamlined for static sites and lightweight dynamic tasks, making them easier but less flexible for complex apps.

What testing strategies work best for this architecture with Stripe, Workers, and Salesforce?

Use Stripe CLI or mocks for webhook testing, wrangler dev for Cloudflare Workers, and Salesforce sandboxes for safe integration. Combine with CI/CD pipelines and a test DB to catch data sync issues early.